ICMA Pakistan

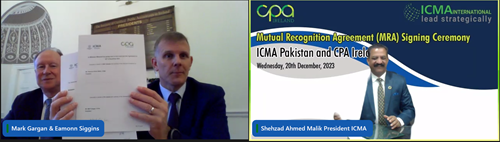

The Institute of Certified Public Accountants in Ireland (CPA Ireland) and the Institute of Cost and Management Accountants of Pakistan (ICMA Pakistan) entered into a mutual recognition agreement (MRA) in 2015. The agreement was renewed in December 2023. It offers qualified members of each body the opportunity to become a member of the other body, and to enjoy the benefits which each organisation offers.

Join CPA Without Ever Leaving Your Home

CPA is one of the best known international accounting designations and Irish professional qualifications are held in high regard worldwide. By becoming a CPA you are joining a global network. Out of some two and a half million qualified accountants worldwide, one million plus are CPAs. The entire application is online so you can become a member from the comfort of your own home!

Member Benefits, Discounts and Professional Services

CPA Ireland provides members with a variety of benefits, discounts and professional services. The full range includes financial, health, publication, lifestyle, technical and professional benefits. Professional and technical resources will enable you to remain up to date and at the leading edge of your profession.

Terms & Conditions

An ICMA Pakistan member seeking admission to CPA Ireland should:

1. Have successfully completed:

a) The ICMA Pakistan examinations,

and,

b) The ICMA Pakistan practical experience requirements,

and

c) Any other requirement as may be prescribed by ICMA Pakistan from time to time,

and

2. Be a member in good standing and not currently subject to any disciplinary sanctions or investigations and has not been subject to any disciplinary sanctions in the past five years,

and

3. Complete and pass the on – line courses and tests:

- “Overview of Irish Tax, and

- “Overview of Irish Law.

and

4. Sit and pass the CPA Ireland Strategy Level examinations in:

a) Advanced Financial Reporting, and

b) One examination from - Data Analytics for Finance, or Advanced Audit & Assurance, or Advanced Tax Strategy (if the Advanced Tax Strategy examination is sat and passed, the requirement to complete and pass the Overview in Irish Taxation would not be required.)

CPA Ireland is not obliged to admit as its Member any Member of ICMA Pakistan who:

(a) is a Member of ICMA Pakistan by virtue of an MRA or any other mutual recognition arrangement with another professional body;

(b) is the subject of a current investigation into his or her professional conduct;

(c) has been subject to any disciplinary sanctions within the five (5) years prior to their application.

You Can Join CPA in 5 Easy Steps:

1. Complete the Online Application form

2. Sit and pass the CPA Ireland Strategy Level examinations in:

a) Advanced Financial Reporting, and

b) One examination from - Data Analytics for Finance, or Advanced Audit & Assurance, or Advanced Tax Strategy (if the Advanced Tax Strategy examination is sat and passed, the requirement to complete and pass the *Overview in Irish Taxation below would not be required.) *we will contact you regarding the step 2 Strategy Level exams once you have completed the Step 1 Online Application form

3. Complete and pass two on-line courses (Both courses are available for €125 each)

4.

Pay Administration fee of €200

5. Send copies all relevant documentation by email to

mra@cpaireland.ie

- Letter of good standing

- 2 References

- Identification (Copy of Passport or Drivers Licence)

- Copy of your Membership Certificate

Should you have any queries please email

mra@cpaireland.ie.